Why Startup Funding is Critical in 2025

Having a great idea is only the first step. To turn that idea into a real business, you need money. Whether you’re starting a tech company or a small online store, money helps you grow, reach more customers, and compete with others.

Challenges Startups Face in Securing Capital

Getting funding isn’t easy. Banks have stricter rules, and investors are more careful. There’s a lot of competition, and the economy keeps changing. That means startups need to be extra smart, careful with spending, and ready to show why their idea is worth the investment.

1. Bootstrap and Self-Fund Your Business

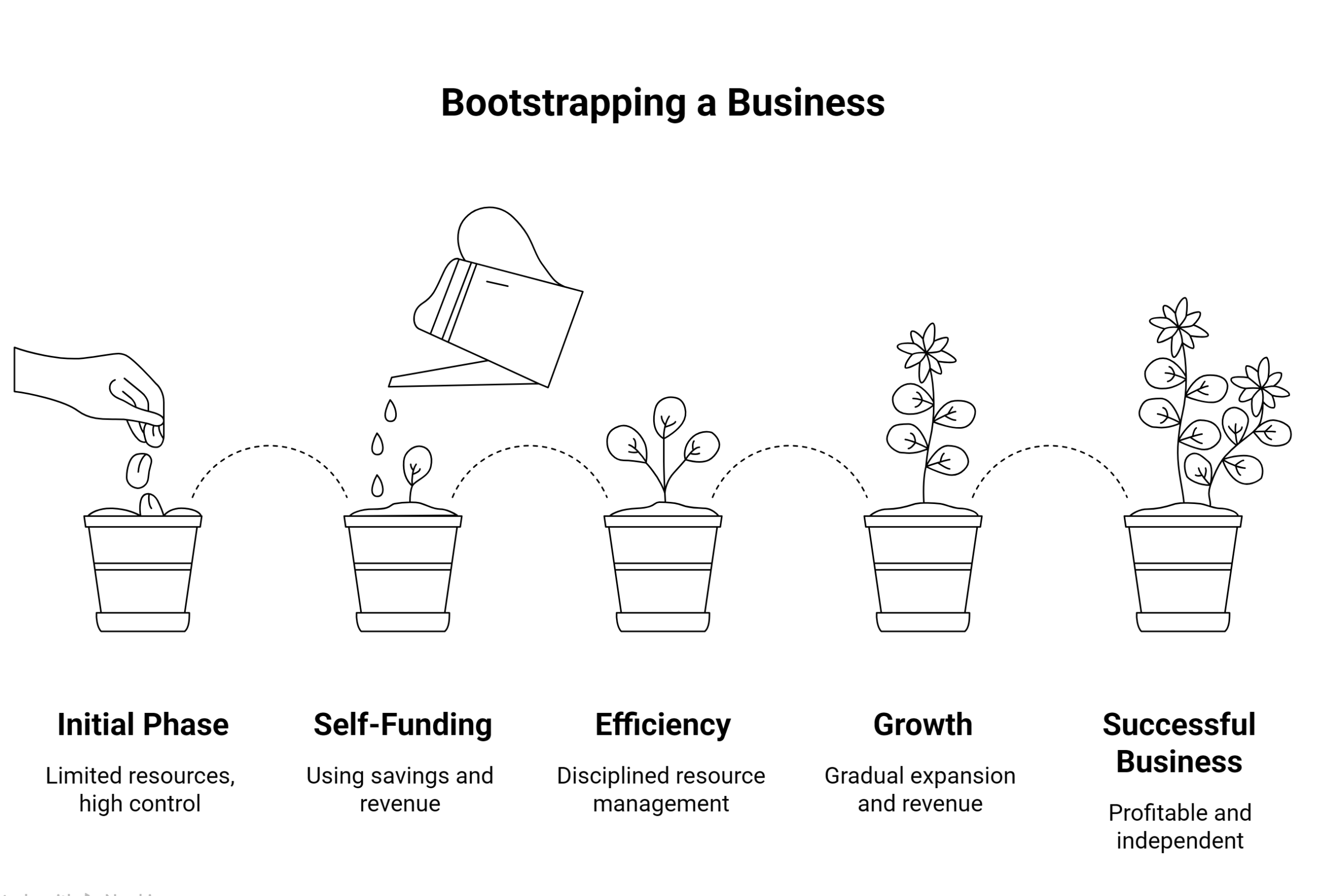

What is Bootstrapping?

Bootstrapping means using your own savings or revenue to fund your business. No loans. No investors. Just hustle.

Benefits of Starting Small

1. You keep 100% control

2. No debt or equity dilution

3. Forces efficiency and discipline

Real-World Examples of Successful Bootstrappers

Companies like Mailchimp and Basecamp started with zero outside funding and turned into multi-million dollar giants.

2. Seek Funding from Friends and Family

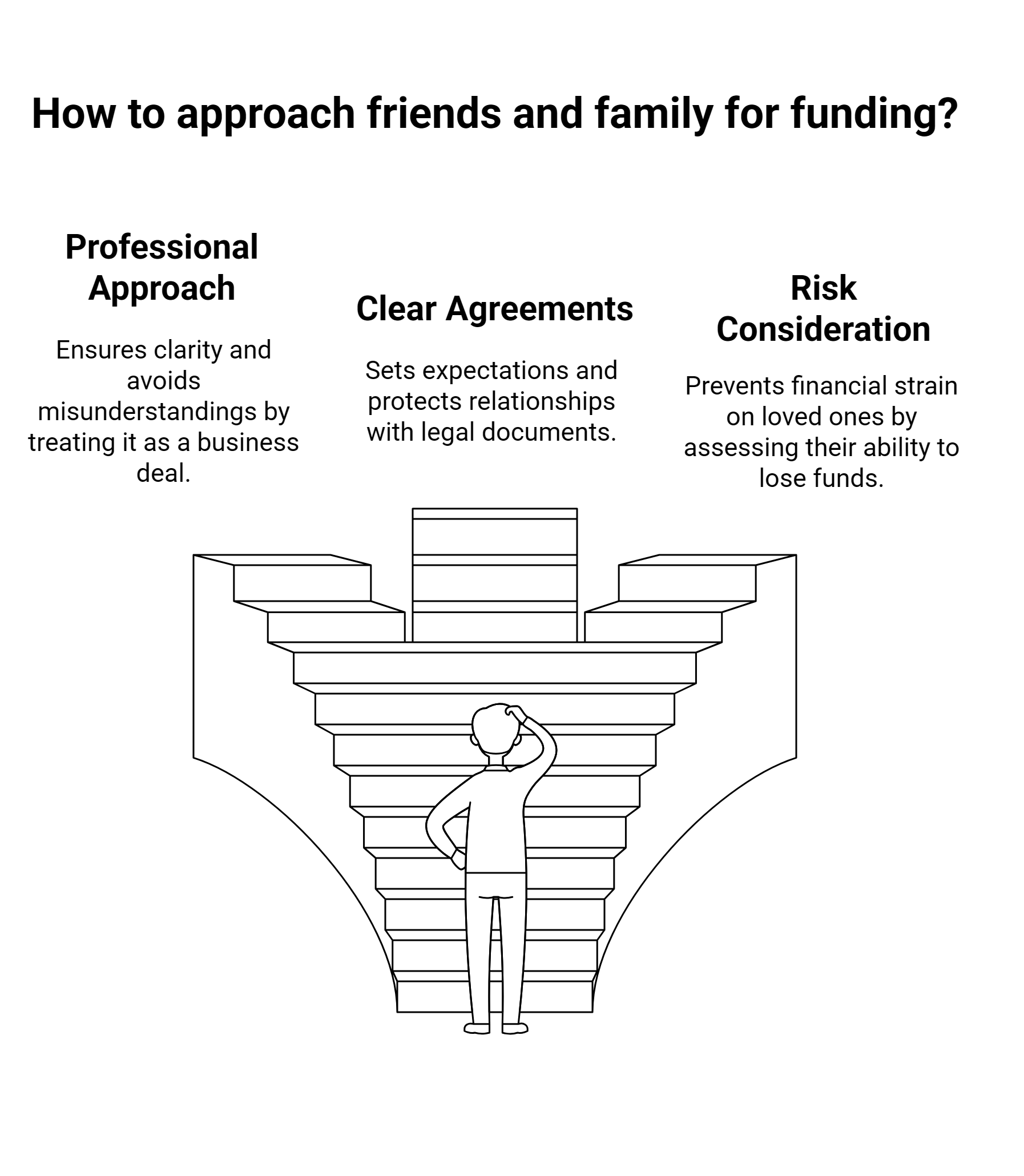

How to Approach Friends & Family Professionally

Create a business plan. Show how the funds will be used. Treat it like a business deal, not a favor.

Setting Expectations and Clear Agreements

Use legal agreements. Clarify repayment timelines, equity terms, or whether it’s a gift. Avoid misunderstanding

Risks to Consider

Mixing money and relationships can get messy. Only take what your loved ones can afford to lose.

3. Apply for Government Grants and Subsidies

Available Government Programs in 2025

Many countries now support startups in sectors like clean energy, AI, and biotech. Look for innovation-focused grants.

Pros and Cons of Grant Funding

Pros: Non-dilutive (no equity loss), often free money.

Cons: Competitive, time-consuming application process.

How to Write a Winning Grant Application

Be specific. Highlight your innovation. Use data. Show how your project aligns with national or local goals.

4. Pitch to Angel Investors

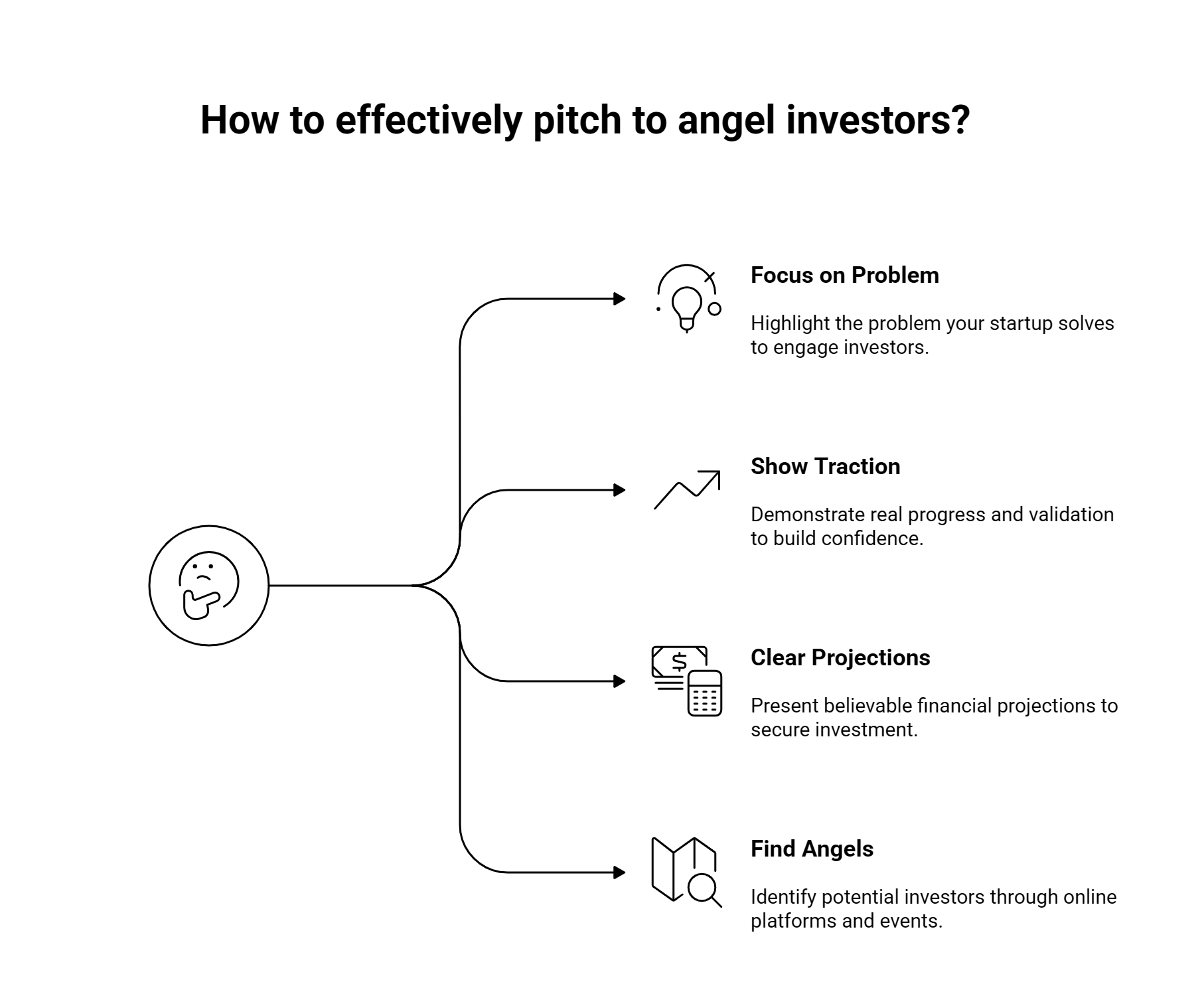

Who Are Angel Investors?

They’re wealthy individuals who fund startups at early stages, often in exchange for equity.

How to Craft a Compelling Pitch

- Focus on the problem you’re solving.

- Show real traction or validation

- Make your financial projections clear and believable

Where to Find Angels in Your Industry

- AngelList

- Local startup meetups and pitch events.

- LinkedIn and startup communities

5. Explore Crowdfunding Platforms

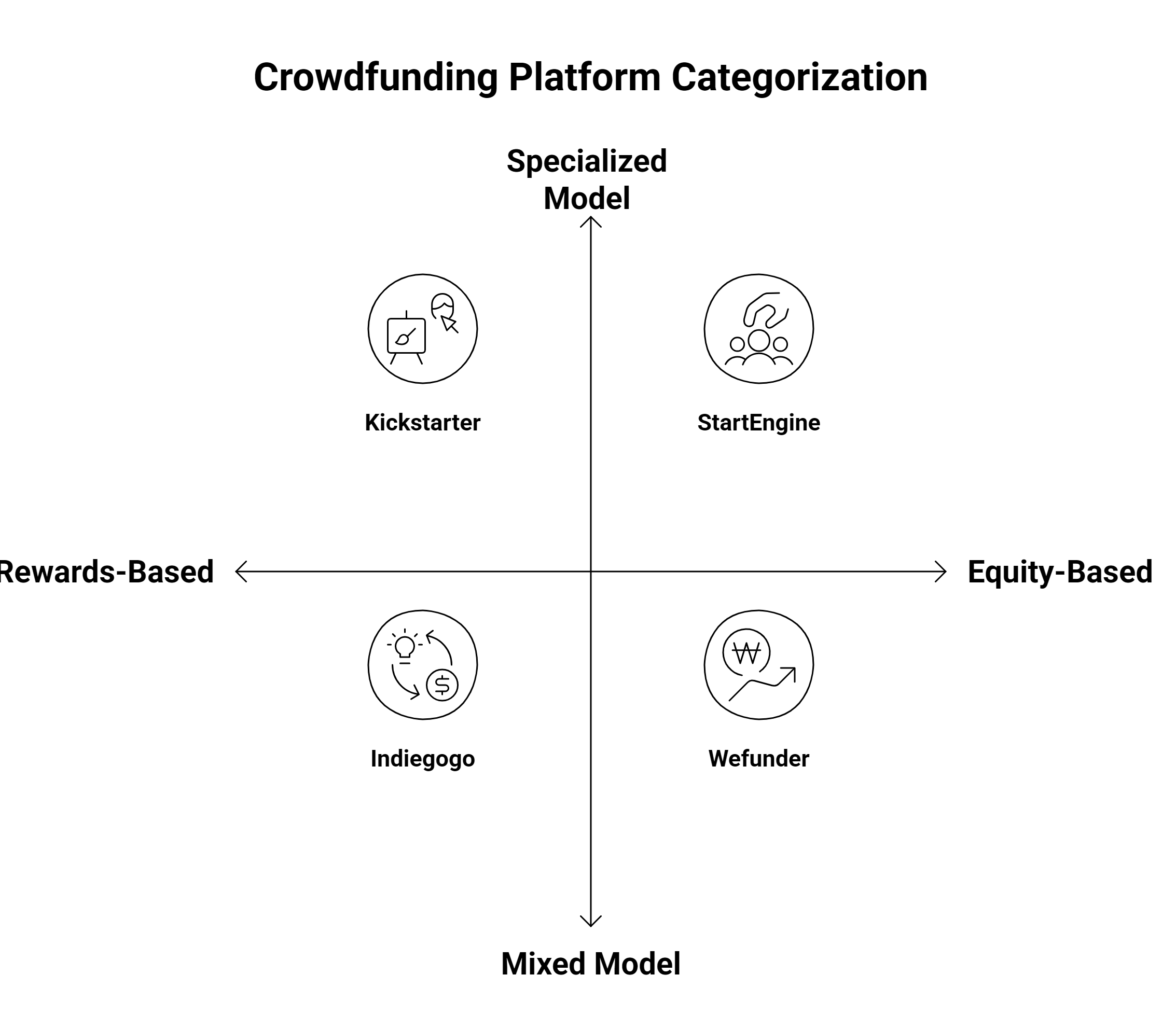

Equity Crowdfunding vs. Rewards-Based

- Equity Crowdfunding: You give up shares in exchange for capital.

- Rewards-Based: You offer perks or products instead.

Popular Platforms in 2025

- Kickstarter (for products)

- StartEngine and Wefunder (for equity)

- Indiegogo (mixed model)

Tips to Run a Successful Crowdfunding Campaign

- Use great visuals and storytelling

- Build an email list before launch

- Offer compelling rewards or ROI

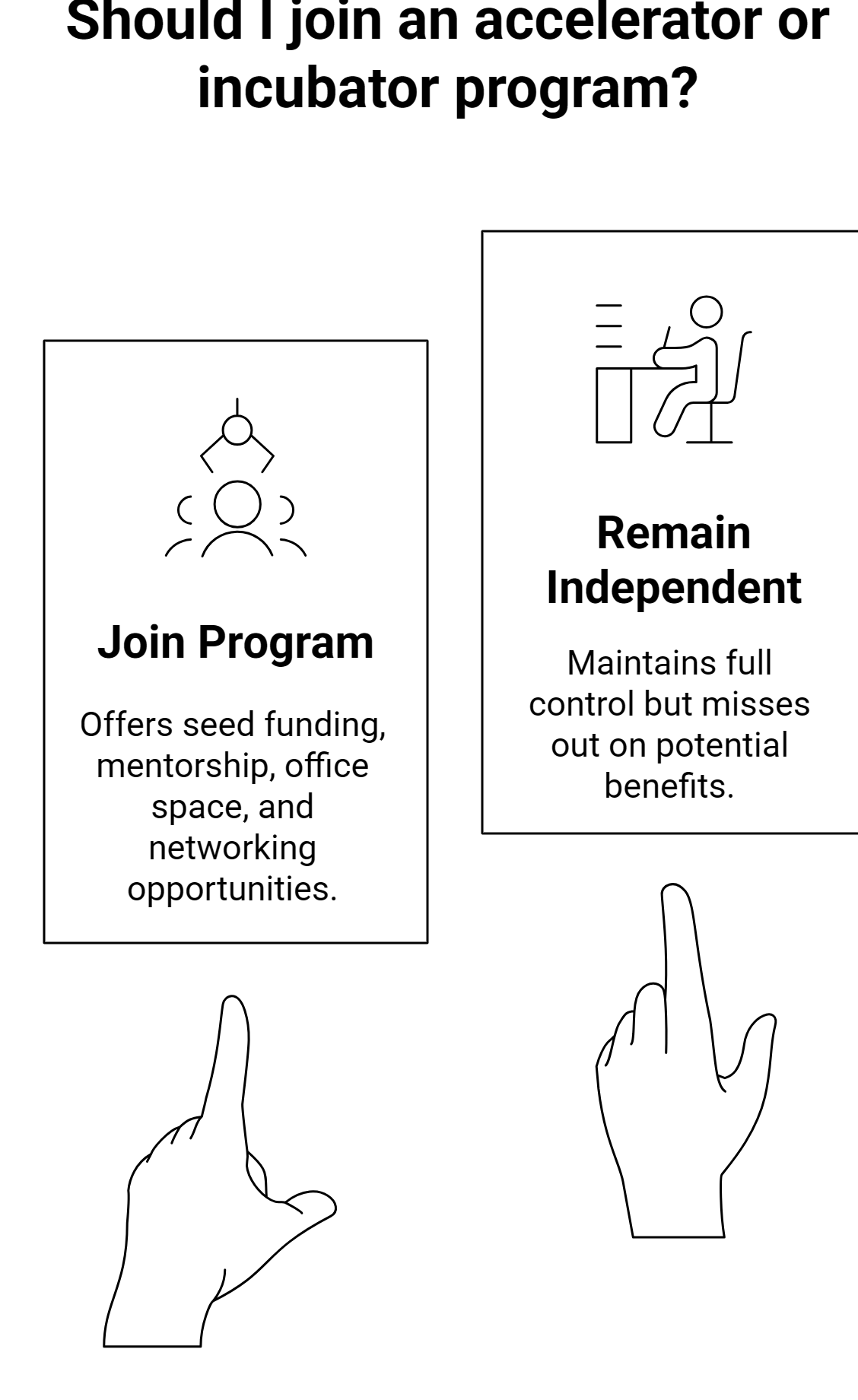

6. Join an Accelerator or Incubator Program

What Startups Get from These Programs

- Seed funding

- Mentorship

- Free office space

- Networking opportunities

Top Accelerator Programs to Consider

- Y Combinator

- Techstars

- 500 Global

- Founder Institute

How to Apply and Stand Out

Be authentic. Show your unique angle. Highlight your team’s strengths and what traction you’ve achieved.

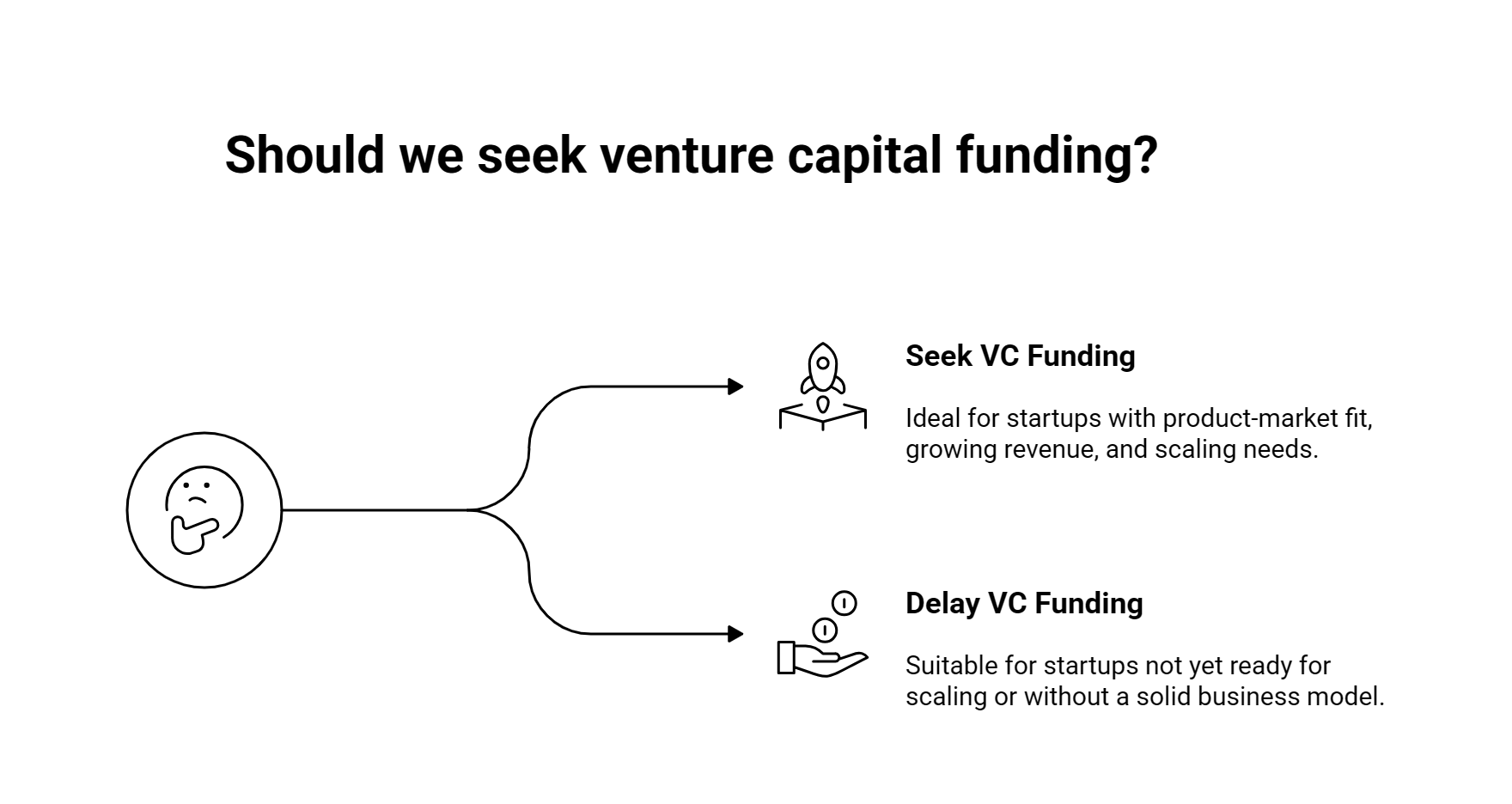

7. Secure Venture Capital Funding

When VC is the Right Move

Once your startup has a product-market fit, growing revenue, and needs serious scaling power, it’s time for VC.

Preparing Your Startup for VC Attention

- Solid pitch deck

- Scalable business model

- Great team and execution record

Bonus Tips on How to Raise Capital for a Startup

Keep Your Financials in Order

Messy books scare off investors. Use tools like QuickBooks, FreshBooks, or hire an accountant.

Build a Solid Business Plan

A strong plan includes your vision, market research, financial projections, and a roadmap to profitability.

Network Relentlessly

Attend startup events, join entrepreneur groups, and never stop meeting potential investors or collaborators.

✅ Don’t Let Funding Stop You — Explore 7 Battle-Tested Capital Ideas Only on Guestify.blog

FAQs

1. How much capital should I raise for my startup?

Raise just enough to reach your next major milestone—whether that’s building an MVP, getting users, or hitting revenue goals.

2. What’s the difference between seed funding and Series A?

Seed funding helps you start up. Series A helps you scale. The former is smaller and riskier for investors.

3. Can I raise money without giving up equity?

Yes! Look into grants, crowdfunding (rewards-based), and revenue-based financing.

4. What do investors look for in a startup?

A strong team, clear market need, traction, and a scalable business model.

5. Is it better to raise money locally or go global?

Start local if possible—it’s easier to build trust. But don’t ignore international options if they align with your startup’s goals.