Venture capital firms for startups play a decisive role in shaping the business landscape. In 2025, these firms continue to empower innovation, fuel entrepreneurship, and drive disruptive solutions across industries. If you are a founder, knowing the top firms and their investment focus can guide your funding strategy.

What Are Venture Capital Firms for Startups?

Why They Matter in Startup Growth

Venture capital firms fund early-stage businesses with high growth potential. They provide not only money but also expertise and access to valuable networks.

Top Industries to Watch

How They Differ from Angel Investors

Angel investors usually invest their own money in smaller amounts. Venture capital firms manage pooled funds from multiple investors, making larger investments with structured oversight.

Focus on AI and Deep Tech

AI, robotics, and machine learning remain top priorities for VC funding.

Sustainable and Green Investments

Firms increasingly fund startups tackling climate change, renewable energy, and sustainable technologies.

Expansion into Emerging Markets

Southeast Asia, Africa, and South America see growing VC attention due to untapped potential.

Top 10 Venture Capital Firms for Startups in 2025

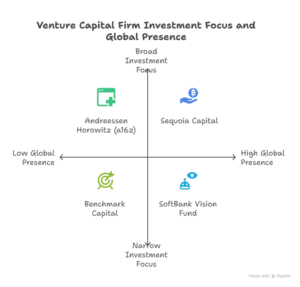

1. Sequoia Capital

Backed companies like Apple, Google, and Airbnb. Sequoia remains a dominant force in tech funding worldwide.

2. Andreessen Horowitz (a16z)

Known for aggressive investments in fintech, crypto, and biotech. Their startup support includes operational resources and strategic guidance.

3. Accel Partners

Invested in Facebook, Slack, and Flipkart. Strong presence in both the US and global markets.

4. Benchmark Capital

Lean, selective, and high-performing. Famous for investments in Uber, Twitter, and eBay.

5. Lightspeed Venture Partners

Actively backing startups in SaaS, AI, and consumer tech. Notable investment: Snapchat.

6. General Catalyst

Focused on long-term founder partnerships. Known for investments in Stripe, Airbnb, and Warby Parker.

7. Bessemer Venture Partners

Diversified portfolio including LinkedIn, Shopify, and Pinterest. Strong in cloud and enterprise SaaS.

8. SoftBank Vision Fund

One of the largest VC funds globally. Invests in large-scale tech companies with global ambitions.

9. Tiger Global Management

Highly active investor with rapid deployment across tech, e-commerce, and fintech.

10. GV (Google Ventures)

Google’s venture arm invests in life sciences, AI, and emerging technologies. They offer access to Google’s resources and expertise.

How Startups Attract Venture Capital Firms

Building a Scalable Business Model

Scalability is a non-negotiable factor for venture capital firms.

Strong Leadership and Teams

VCs look for experienced, adaptable, and committed founders.

Market Fit and Growth Potential

Products with proven demand and room for expansion stand out.

Challenges in Securing Venture Capital

High Competition

Thousands of startups compete for limited funds.

Stringent Due Diligence

Firms analyze financials, operations, and risk thoroughly.

Equity Dilution

Founders trade ownership stakes for funding, which may reduce control.

Benefits of Partnering With Venture Capital Firms

Access to Capital

Startups gain financial resources for scaling operations.

Mentorship and Strategic Guidance

VC firms provide expert advice to avoid common pitfalls.

Network and Partnerships

Connections with other startups, corporates, and investors accelerate growth.

Future of Venture Capital Beyond 2025

More Diversity in Funding

Focus on women-led and minority-led startups increases.

Blockchain and Crypto-Focused VC Firms

Specialized funds target Web3 innovations.

Cross-Border Investments

Global collaboration grows, with VCs funding international startups.

Conclusion

Venture capital firms for startups in 2025 are more dynamic than ever. From AI-driven solutions to sustainable innovations, they continue to drive the future of business. For founders, knowing which firms align with your vision can make the difference between stagnation and exponential growth.

Want to share your expertise or showcase your startup journey? Submit your story through our guest post platform.

Need tools to boost your digital visibility? Explore our best SEO tools.

FAQs

1. Which venture capital firm is best for startups in 2025?

Sequoia Capital, Andreessen Horowitz, and Lightspeed Venture Partners are among the most active and impactful.

2. How do I approach a venture capital firm?

Build a solid pitch deck, demonstrate market potential, and network through introductions.

3. Do VCs invest in early-stage startups?

Yes, but most prefer businesses with some traction, revenue, or proof of market fit.

4. What industries attract the most VC funding in 2025?

AI, fintech, health tech, sustainability, and SaaS lead the way.

5. How much equity do VCs usually take?

Typically between 15% and 30%, depending on investment size and negotiation.